In 2025, Medford homeowners can finance an ADU. They use standard options like home equity loans and HELOCs. Also, construction loans are available. Typically, interest rates are between 6% and 9%. Furthermore, the city helps a lot. It offers a program that cuts costs. Specifically, it reduces system development charges (SDCs) for ADUs.

Getting started means understanding the specific financing available for ADU construction in 2025. For instance, options include Home Equity Lines of Credit (HELOCs). They also include specialized construction-to-permanent loans. We at Gather ADU help homeowners navigate these diverse options. We connect them with trusted lenders.

How Homeowners Are Using ADU Loans to Boost Property Value in Oregon?

Homeowners in Oregon finance ADUs. These ADUs are cottages or conversions. They are built to boost home value. Crucially, these loans use the property's future value. This value includes the ADU's worth. Therefore, this strategy increases borrowing power. Furthermore, the units generate rental income. They can also house a family. Key benefits include:

- Boosts property value

- Creates rental income

- Attracts diverse buyers

- Offsets building cost

The ADU investment is viewed as a strategic financial move. Furthermore, it enhances both the property's functionality. It also boosts long-term market desirability. By securing cost-effective funding, homeowners benefit. Also, utilizing local incentives, like SDC reductions, is helpful. This ensures their ADU provides maximum financial benefit.

What ADU Financing Options Are Popular in Oregon?

Popular ADU financing options in Oregon utilize three things. These are home equity, construction loans, and state grants. Specifically, homeowners use a HELOC for funds. This money can be drawn as needed. Alternatively, they use a cash-out refinance for a lump sum. Furthermore, Construction-to-Permanent loans streamline funding. They combine funding into one mortgage.

These financing options are often paired with local ADU incentives. This ensures the project's financial success. In addition, securing funding helps. This funding must account for the potential rental income. This strengthens the borrower's qualification profile. Ultimately, this strategic approach ensures the homeowner can fully capitalize on the investment.

How Does an ADU Increase a Property's Resale Value?

Adding an ADU significantly boosts a property's resale value. Specifically, it increases usable square footage. Furthermore, it generates potential rental income. This combination attracts a wider buyer pool. These buyers seek flexible living or investment opportunities. Ultimately, the extra living space and rental potential make the property much more desirable.

- Adds a valuable income stream

- Increases total appraised square footage

- Attracts a diverse range of buyers

- Provides flexible living arrangements

- Future-proofs the property's use

The added functionality and financial benefit are seen as a strategic asset. This is true for the long term. Therefore, this feature often results in quicker sales. It also leads to higher offers. This happens when compared to similar homes without the secondary unit. This is because buyers recognize the instant value.

What is a Construction-to-Permanent Loan?

A construction-to-permanent loan is a single mortgage. This mortgage covers both building the home and the final financing. During construction, the borrower only pays interest. This interest is in the funds used to pay the builder. Then, once the home is finished, the loan automatically switches. It becomes a permanent mortgage. This requires full principal and interest payments.

Consequently, this loan converts automatically. It becomes a permanent, fully amortized mortgage once the ADU is finished and certified. Therefore, this streamlined option saves the homeowner time and money. It does this by requiring only one set of closing costs. It also allows them to lock in their long-term interest rate early in the process.

What Local Incentives Exist for Building an ADU in Medford in 2025?

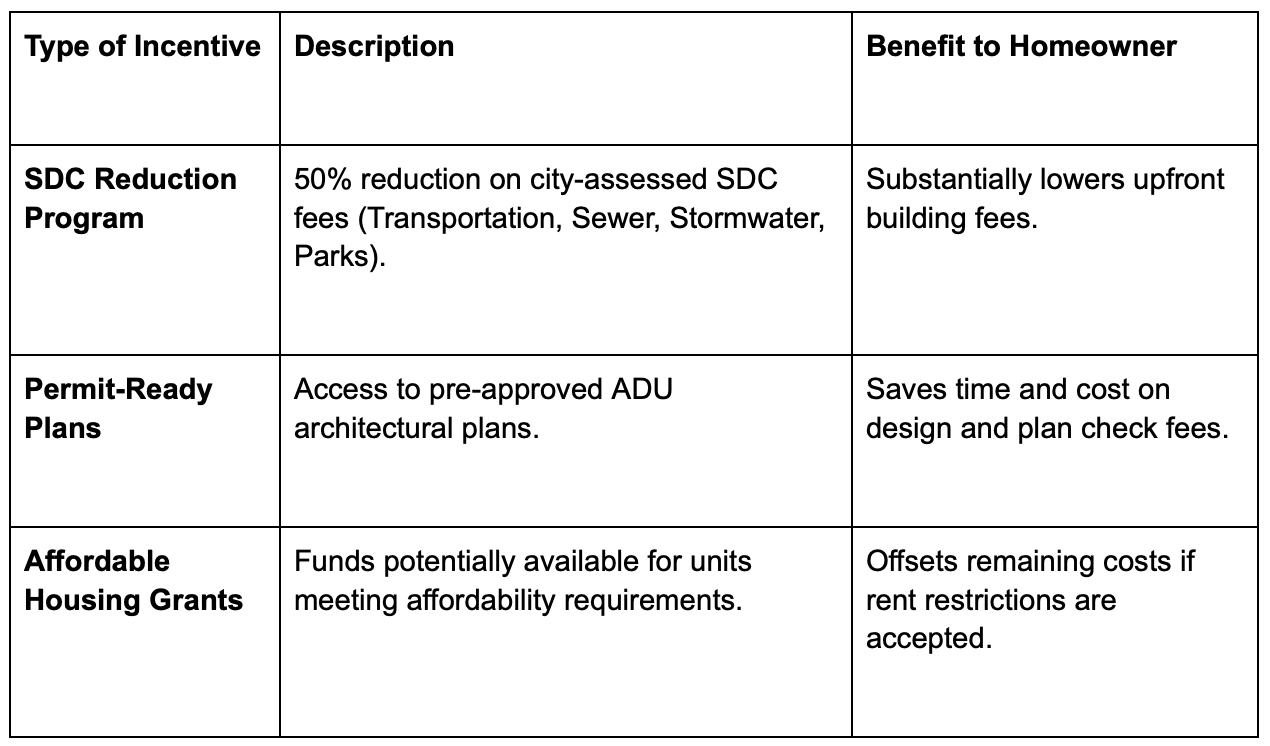

The main local incentive in Medford, Oregon, is the ADU System Development Charge (SDC) Reduction Program. This program cuts SDC fees for new building permits by 50%. This continues until June 30, 2027. This reduction impacts costs for essential services. These include transportation and sanitary sewer. While county or private incentives might exist, state programs are not directly linked to Medford's local offers.

Consequently, these SDC reductions can significantly lower the total upfront construction cost. As a result, this makes the ADU investment immediately more financially viable for many residents. We also recommend checking for additional local energy-efficiency rebates. Or, look for affordable housing pilot programs.

Make Your Dream Home a Reality with Gather ADU

Many people are struggling to navigate the complexity of ADU financing. In fact, they are often worried about selecting the wrong loan product or missing out on key SDC reductions in Medford. The sheer number of options, from HELOCs to construction loans, can lead to confusion, higher long-term costs, and delays. This slows down the start of your valuable income-producing project.

Let Gather ADU simplify your financing journey and secure the best ADU loan rates for you. Our team specializes in connecting Oregon homeowners with the right lenders. We also transparently compare loan features. Our expert support ensures you select the best financial strategy. This helps maximize your equity and realize your ADU income potential quickly.

FAQs

Is a Construction-to-Permanent loan better than a HELOC for an ADU?

The main Medford ADU incentive is the SDC Reduction Program, cutting fees by 50% until June 30, 2027. To qualify, new ADUs cannot be used as short-term rentals for 10 years, which requires a restrictive covenant.

How much value does an ADU typically add to a Medford home?

An ADU can add substantial value to a Medford home. Estimates suggest it could increase the property's assessed value by 25% to 34%. Furthermore, resale value could potentially jump by 30% to 50% or more.

Are there any grants available for ADU construction in Oregon?

Yes, Oregon sometimes offers grants and incentives. These often focus on sustainable or affordable housing initiatives. Homeowners should check programs from organizations like Craft3 and the Energy Trust of Oregon. Consult local city or county housing divisions for current offerings and eligibility.

Do I need a special contractor for an ADU construction loan?

Yes, most construction-to-permanent lenders require a licensed contractor. This contractor must also be insured and experienced. Furthermore, this builder must be officially approved by the bank. This mitigates risk for the lender. It also ensures the ADU project is completed.

What does the Medford SDC reduction program entail for ADUs?

The Medford SDC reduction program has a clear aim. It wants to lower the high System Development Charges assessed for new ADUs. Consequently, this incentive reduces major city fees. For example, it reduces fees for water or sewer.